Driving Industry Reform

Driving Industry Reform

By Anna Guy

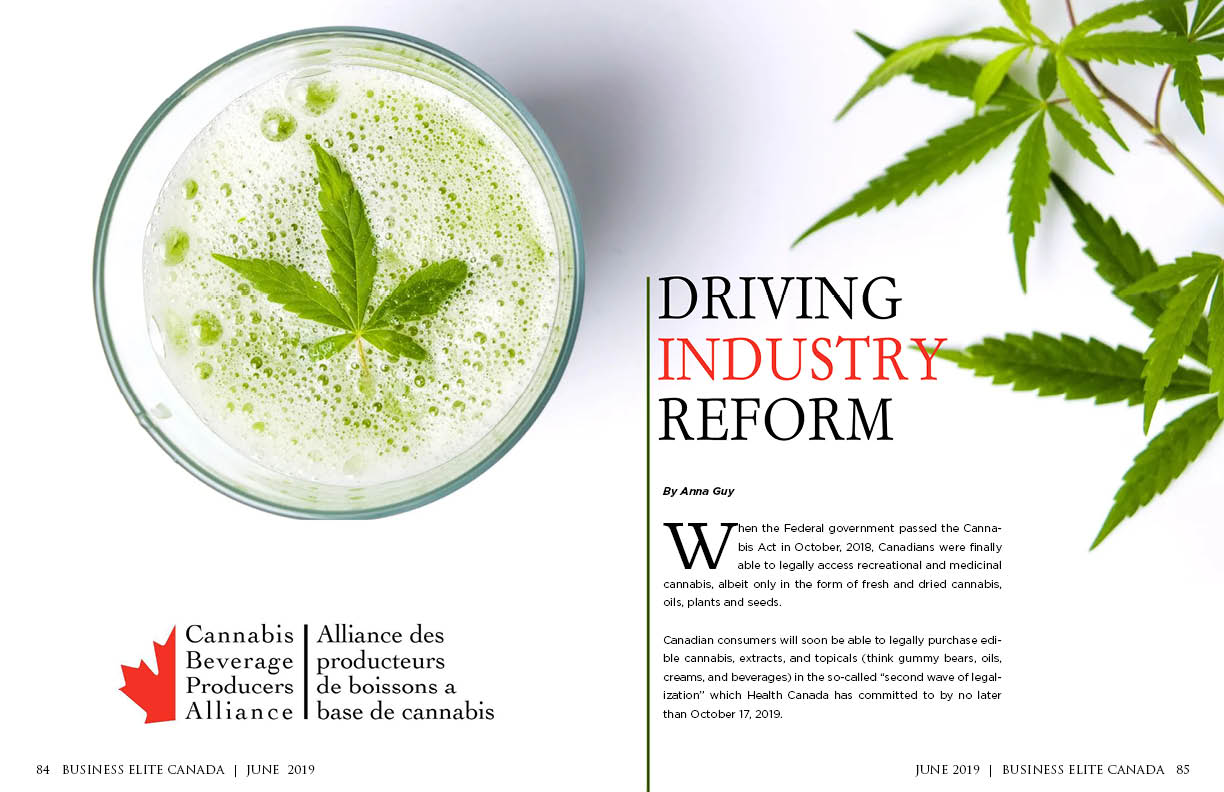

When the Federal government passed the Cannabis Act in October, 2018, Canadians were finally able to legally access recreational and medicinal cannabis, albeit only in the form of fresh and dried cannabis, oils, plants and seeds.

Canadian consumers will soon be able to legally purchase edible cannabis, extracts, and topicals (think gummy bears, oils, creams, and beverages) in the so-called “second wave of legalization” which Health Canada has committed to by no later than October 17, 2019.

As public officials and private manufactures strive to find a fine balance between health, safety, and revenue, Health Canada sought public consultation as part of drafting regulations around this new form of cannabis consumption.

This was the impetus for the formation of a new industry group called the Cannabis Beverage Producers Alliance (CBPA), which organized in response to Canada’s proposed regulations around edibles.

The 10-member group, led by former Nova Scotia premier Darrell Dexter, is comprised of manufacturers, industry professionals, and advisors, both within Canada and beyond, from across the cannabis, beverage, alcohol and affiliated industries.

Business Elite Canada spoke with June Nicholson, co-chair of CBPA and Executive Vice President, Partnerships and Government Affairs for Hill Street Beverage Co., on the suggestions made by the alliance to Health Canada that may impact how and where consumers can buy cannabis beverages in the near future.

“We want to work together with Health Canada to form common-sense regulations for the industry,” says June Nicholson. “There are a number of restrictions that are a little concerning for the industry on the whole. Some broad stroke categories would be marketing and advertising, nomenclature, and production.”

Shelf Appeal

As it stands now, Health Canada’s vision is for every cannabis beverage on the shelf to be in a uniform package with only very small differentiators to indicate the brand and/or qualities of the beverage. This stands in great contrast to what the consumer experiences when purchasing an alcoholic beverage, where a large variety of products may be in standardized containers, but are easily identifiable so that the consumer knows confidently and quickly what he or she is buying. The CBPA would like to see cannabis beverages marketed in the same way.

“Health Canada has mandated various stringent rules around how cannabis beverages can look,” says Nicholson. “Under the draft regulations, cannabis beverages would be packaged in a single colour, with the bright THC stop sign icon, and only a very small indication of what the product actually is. We understand, expect, and agree with Health Canada’s position that beverages should not be appealing to children, however there are certain aspects that we feel are overreaching.”

Production Facilities

Of major concern to the CBPA is Health Canada’s proposal that producers make their product in an entirely separate facility from where conventional food is produced. For an established beverage producer (such as Hill Street Beverage Company), this would mean building an entire new building to produce its cannabis beverage.

“This approach will have unintended consequences on the industry writ large,” says Nicholson.

The CBPA once again looks to the established beverage alcohol industry, in which each producer holds a wine, spirits, brewery license, refresh license or a distillation license, and they monitor for cross-contamination, separation of storage materials and abide by strict standard operating procedures.

“This will place an undue burden on the industry,” says Nicholson. “Canada has world-class food allergen-control procedures, and food and beverage manufactures have operated under that process plan for many years with no consequences. To layer on a level of difficulty for manufacturers would prohibit smaller players from being competitive in that space. By layering on the cost, these players will have trouble being competitive, which drives consumers to underground markets.”

Come October, consumer demand will be high—according to a 2018 report by Deloitte, 31 per cent of potential consumers are interested in trying cannabis beverages, and a positive experience is vital for retaining this market. “Consumer experience is key,” says Nicholson. “The experience consumers have starts on the shelves and goes to consuming the product. That’s why we are so concerned about drawing consumers to the repeatable, stable products you can depend on from a legal beverage producer.”

Establishing guidelines will be an ongoing basis. “We hope to mirror how alcohol came from prohibition to legalization with history of safe adoption as the guideposts; but in a much more reduced timeframe,” says Nicholson.