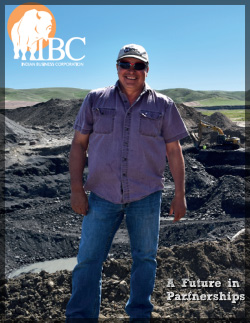

A Future in Partnership

As Rob Rollingson, GM of Indian Business Corporation (IBC), tells me about the time a gentleman came and asked for a few thousand-dollar loan, I can sense the passion in his voice. On paper, Rollingson knew it was not the safest loan due to the fact that the man had little collateral, however, Rollingson, through IBC, granted the loan and the man went out and bought a few head of cattle. After repaying the loan, he came back for another, and later another, until the man had grown a business big enough to sustain himself and his family within a few years.

For many Indigenous Albertans, starting a business can mean economic prosperity and an improved quality of life for themselves and their families. The success of a local business also means more local spending and better social and economic outcomes for the community.

Since 1987, IBC has lent out over $100 million in loans to First Nations’ business and individuals across numerous sectors and disciplines including agriculture, heavy equipment & transportation, service and hospitality industries. But for the people who work at IBC, it is not this tremendous dollar figure, but the contribution to social impact, that is the true measure of success.

IBC is an Indigenous Financial Institution in Alberta that provides development lending and financial services to First Nations’ business and individuals across numerous sectors. “I’ve worked in the financial industry from mainstream banking institutions to my current workplace, Indian Business Corporation (IBC),” says Rollingson. “At IBC, we still have to have our bottom line, but we measure success by the amount of opportunity we provide First Nations people to participate in the economy and the social changes that happen once a person has access to capital.”

Overcoming Economic Barriers

The Canadian economy works on the principle that access to capital is critical to economic competitiveness. But the fact is, access to both conventional and creative financing has been a barrier to First Nations, Métis and Inuit communities across Canada. IBC initially started in the agricultural sector but diversified as opportunities in other areas materialized.

On a mission to ensure every viable First Nation entrepreneur has access to capital, IBC “creates economic development through lending and financial services to First Nation’s individuals and businesses.” In its three decades, IBC has helped fund over 2,500 businesses, directly and indirectly contributing to 7,000 jobs in Western Canada.

Siksika First Nation

IBC has established a pioneering relationship with the Siksika First Nation, one that Rollingson believes is a viable model for other First Nation communities. Along with a $700,000 injection from the Alberta government, the Siksika Nation created a total fund of $2.7 million for Siksika members to grow or build their business. IBC’s goal is to do three things with this fund. “We believe we can maintain their capital and pay a small return,” says Rollingson. “But the most important thing this accomplishes is supporting the Siksika community members to participate in employment, hiring, and all these other things that come along with independent commercial success.”

“Siksika has been a great partner and have taken a leadership role for First Nation communities in Canada in assisting their own Nation members with this unique agreement,” says Rollingson.

“Siksika is proud to create a fund that goes towards improving access to capital to help the next generation of entrepreneurs for the people of Siksika Nation to greater prosperity and health,” said former Chief Vincent Yellow Old Woman. “Siksika Nation, Government of Alberta and IBC are working together to ensure Siksika Nation members have “access to capital” to further advance their future.”

AltaGas

AltaGas has for many years recognized the importance of providing financial support to assist First Nations in promoting and achieving social and business objectives. In 2014, through their First Nations Development Fund, AltaGas provided IBC with an interest free loan of $500,000.00. David Cornhill, Chairman and CEO of AltaGas stated that “AltaGas is always seeking new opportunities to create sustainable social value,” said David Cornhill, Interim Co-Chief Executive Officer of AltaGas. “I know firsthand how important it was to have financial support when we started AltaGas 20 years ago and we wanted to be able to do the same for others, but specifically for First Nations entrepreneurs. Through this agreement with IBC, AltaGas is able to support the creation and growth of sources of revenue for First Nations.”

Female-Focus

IBC recently launched an Indigenous Women’s Fund to empower Indigenous women with the capital to start their own businesses, build capacity, promote self-sufficiency, and create opportunities. In an exhaustive and thorough strategic plan, IBC is investigating the economic barriers specific to Indigenous women in Canada, then creating training, programs, and business plans aimed directly at overcoming them.

“We recognize that this is an important and complex issue, and that the ideas presented in their strategic plan represent the first steps toward addressing it,” says Rollingson. “However, unless further concrete action is taken, the situation will not improve. We believe the following two steps are essential to ensuring Indigenous women have greater access to entrepreneurship: to establish Canada’s first dedicated loan fund for Indigenous women’s entrepreneurship, and ensure women are at the centre of the development of this fund.

Rollingson says First Nations members in Western Canada are welcome to approach IBC anytime. Together, he says, IBC hopes to establish a level playing field for all those participating in the Canadian economy.

www.indianbc.ca