O

ne of Canada’s largest initial public

offerings in 15 years, and the biggest

transaction in Ontario history, became of-

ficial on Nov. 5 when shares in Hydro One

began trading on the Toronto Stock Ex-

change.

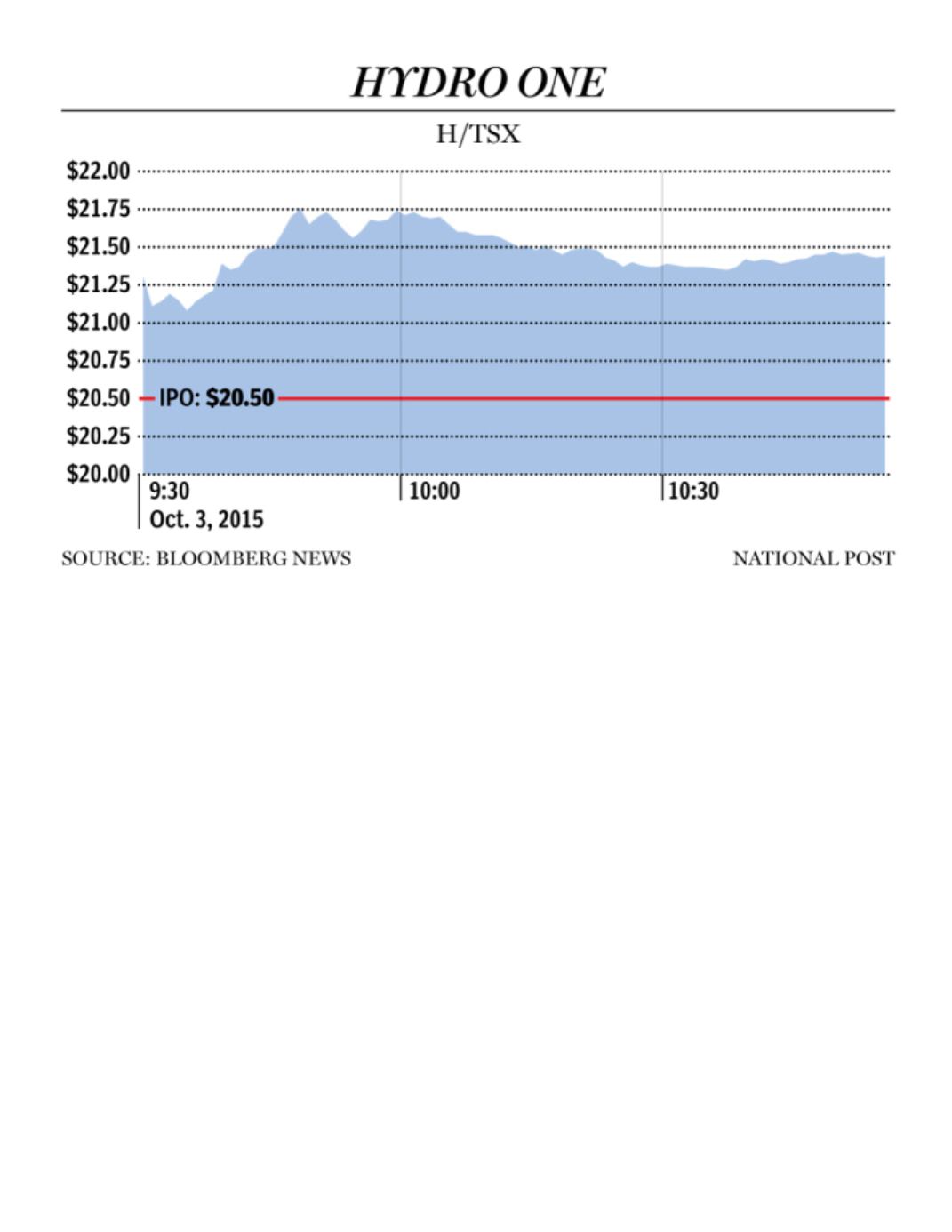

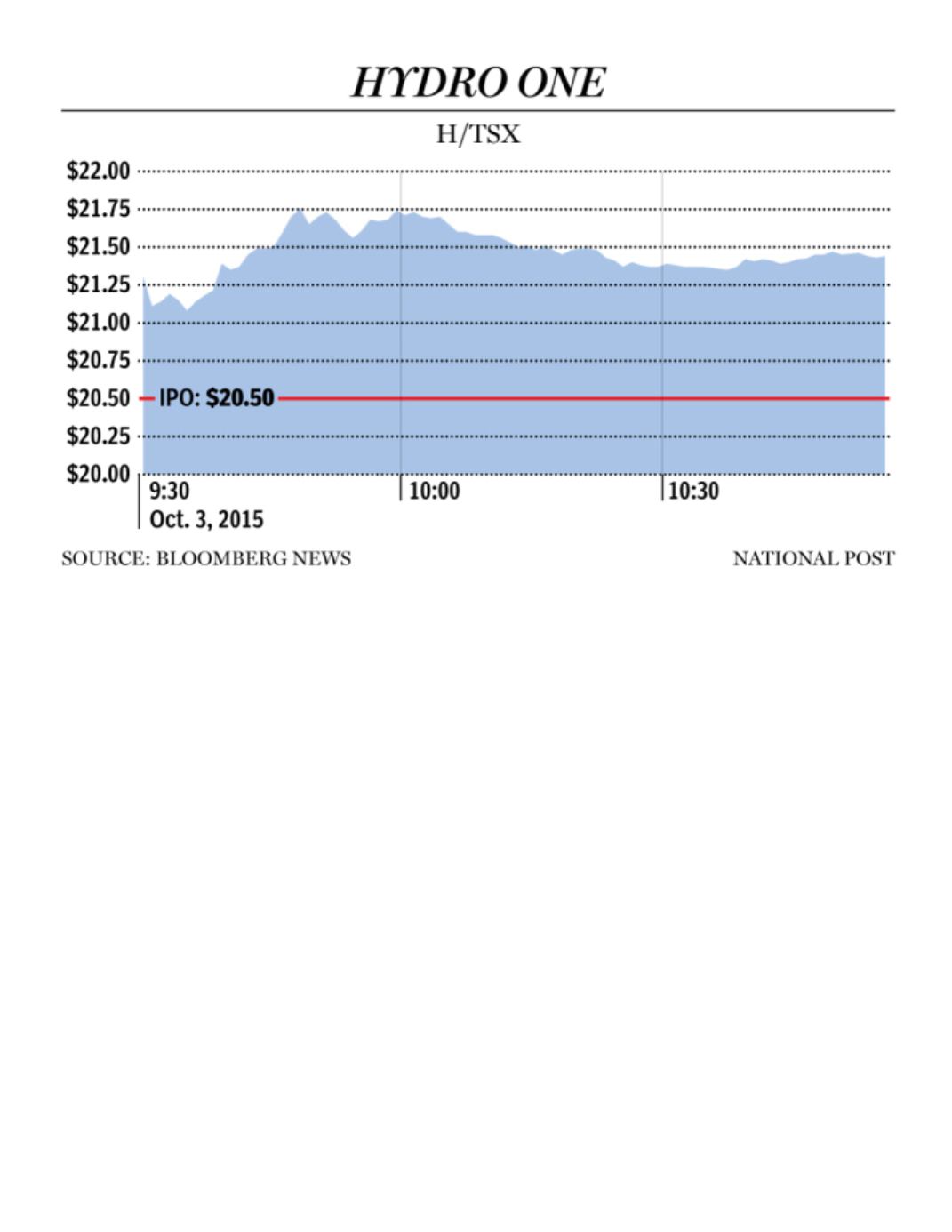

More than 81 million shares were of-

fered at an IPO price of $20.50 per com-

mon share with the potential of bringing in

$1.66 billion in proceeds for the Province

of Ontario. Within the first half hour, more

than 10 million shares had been sold and

by early afternoon, the shares were trad-

ing at $21.60, finally closing at $21.62. The

offering was made through a syndicate of

underwriters led by RBC Capital Markets

and Scotiabank.

The common shares of the Company are

listed on the Toronto Stock Exchange un-

der the symbol “H”. Upon closing of the

offering, there were 595,000,000 com-

mon shares issued and outstanding in the

capital of Hydro One Ltd., of which the

province owned 513,900,000 representing

86.4 percent of the issued and outstand-

ing common shares, a Hydro One news

release stated. The province had granted

the underwriters an over-allotment option

NOVEMBER 2015

H

business elite canada 9