resilient, bouncing back after recession

years and dropping only a couple of per-

centage points when the economy takes

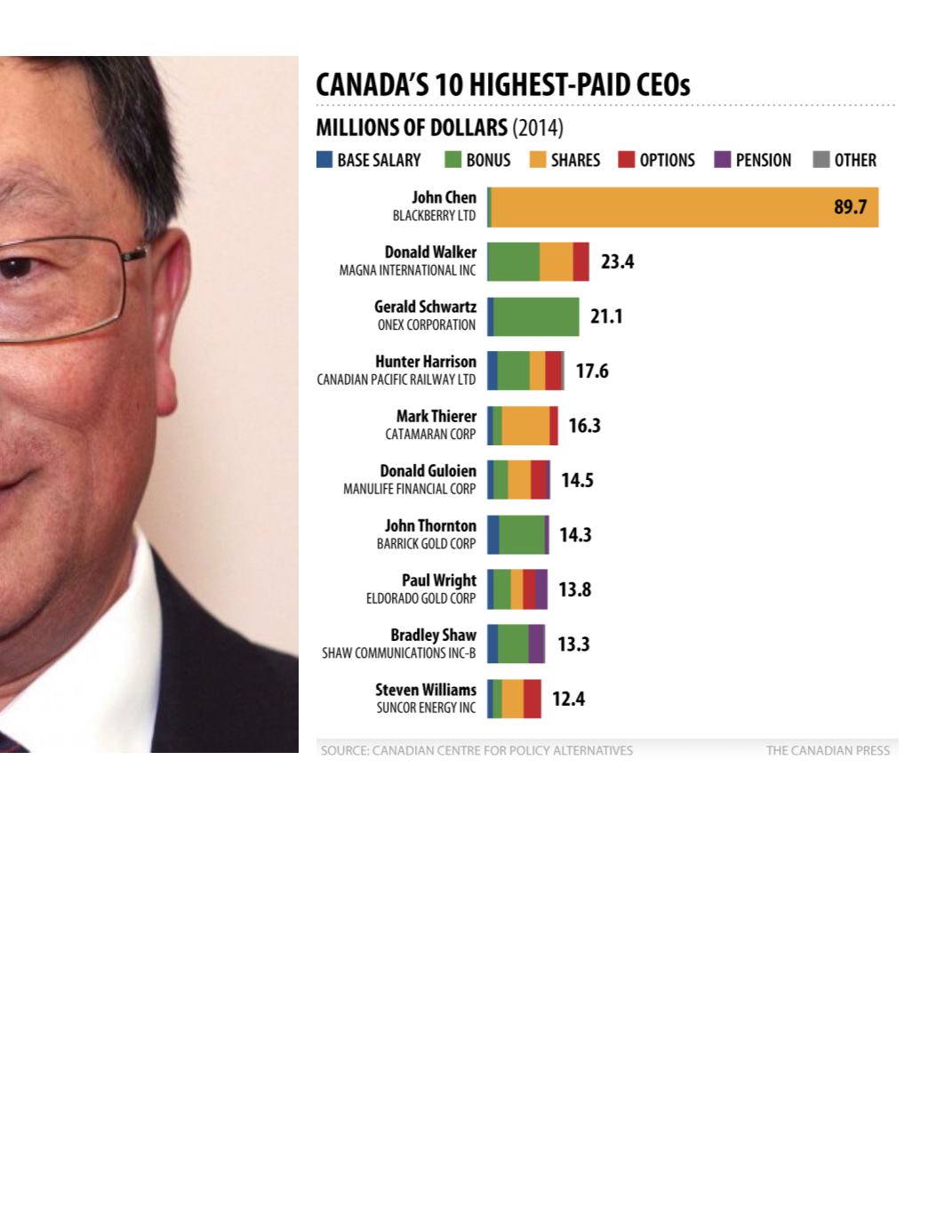

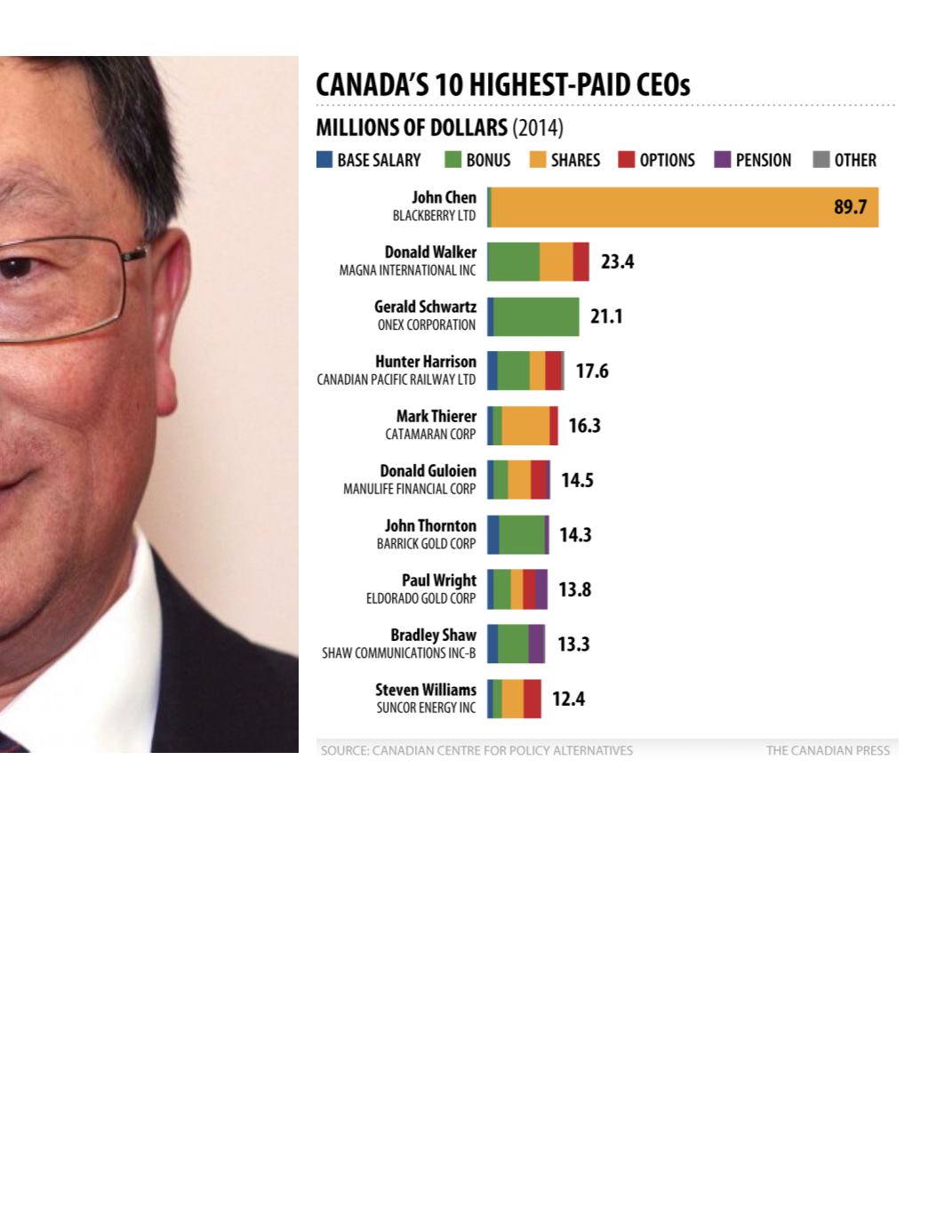

a downturn. One recent trend has shown

that share grants are replacing stock op-

tions as a form of higher pay. Stock op-

tions dropped from 21 per cent of pay in

2008 to 13 per cent in 2014, while share

grants rose from 26 per cent in 2008 to 39

percent in 2014.

Close to half of the CEOs in the study had

pensions averaging $961,000 annually,

markedly close in value to their $1.1 mil-

lion average base salaries.

The CCPA’s study, Staying Power: CEO Pay

in Canada, is based on total earnings of

CEOs on the 249 publicly listed Canadian

corporations in the TSX index and repre-

sents 2014 earnings data.

JANUARY 2016

H

business elite canada 13