Operational dates expected as early as 2018

By Leah Kellar

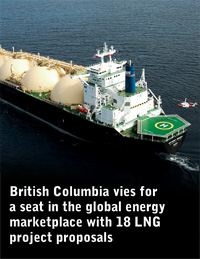

B.C is fixed to cater to the global energy marketplace with 150 years supply of natural gas while requiring only 30 per cent recovery rate of its known reserves. The province is working with companies and investors around the world to promote its liquefied natural gas (LNG) production with 18 LNG project proposals already at various stages of progress.

“Every single major company that’s involved in energy in the world now has started to make significant investments in Canada or British Columbia,” said B.C’s Deputy Premier and Minister for Natural Gas Development, Rich Coleman, in a recent interview with Business Elite Canada.

Liquefied Natural Gas (LNG) is natural gas cooling down to a temperature of -161 degrees Celsius, at which point it becomes a liquid that can be exported to anywhere in the world by ship.

Mr. Coleman described the significant on-going progress made to each of 18 LNG project proposals primarily located in the Northwestern part of the province. Pacific Northwest LNG is one, which has a partnership with Petronas and has advanced a long way to move into LT engineering. Projects in the Northwestern part of B.C. are the most advanced. BG Group is there with Exon-Mobile Company and both have bought land to site their proposed production plants. North of Prince Rupert there are two other advanced projects of CNOOC-Nexen. CNOOC-Nexen is based in China and has a worldwide interest in petroleum resources. The company has auctioned lands in the Grassy Point area of the province, as has Woodside Petroleum, an Australian company. In Kitimat along the Northern coast, there is LNG Canada, which partnered with Shell Corporation. The Shell project is a partnership between Shell, Mitsubishi, PetroChina and Korean Gas Corporation. This area has progressed with their work in plans for pipelines with First Nations.

“When it comes to shovel ready projects, they’re probably one of the closest,” said Mr. Coleman.

B.C is in a prime location in the saturated marketplace in North America where supply greatly exceeds the current demand that drives natural gas prices down. The province’s geographical situation on the Pacific coast makes shipment direct to Asia—currently Canada’s biggest international energy market investor— fairly convenient compared to that of its biggest competitors. Selling to Asia requires moving natural gas to the continent through the liquefying process. And if Asia and other international companies and investors are sold on B.C’s production; this means higher royalties, revenues, and GDP.

“It’s a significant contribution, not only to B.C’s GDP, but Canada’s GDP— in the billions of dollars,” Mr. Coleman said.

One liquefied natural gas (LNG) plant in the province can net about $75-billion or more in capital investment, in addition to the actual movement of the product. And natural gas in its relatively new liquefied form facilitates easier international shipment. The minister stressed that natural gas supply industry in B.C. is no longer a just a player in the provincial or national marketplace, but it is now competing in a global marketplace, offering a global product. He says the province is already energy self-sufficient. B.C manages the grid that moves electricity powered by its natural gas production to other markets north and south of the United States border and into Alberta.

Each of the proposed LNG projects will be an investment of approximately $20-$25-billion if taken to what is known in the industry as the final investment decision stage. This is where investors move to actual site development involving construction of a plant and putting a pipeline into place, etc.

Mr. Coleman estimates that they will spend in the range of another $500 million to $1 billion to get to the point of making their financial investment decision. All of the 18 have made similar progress to secure sites and begin preparations governed with long-term strategies in place. Some of the projects have tentative operational dates as early as 2018, and about four or five are aiming to make their final investment decision by 2016. Mr. Coleman expects one of the first to be made as early as next year.

“I’m pretty pleased with the progress. I expect we’ll get a final investment decision sometime in the first or second quarter of next year, which will then kick-start things into high speed,” said Mr. Coleman.

A number of international and Canadian companies are involved in each one of the projects at different levels, such as Shell and Petronas, and already have set up the finance and management of their Canadian operations. The B.C government’s LNG Strategy has been all over the news in the past few years since it was announced in 2012.

“It’s really a focused document for government, but it also tells people where we’re headed,” said Mr. Coleman.

The focus of the LNG Strategy authored by the B.C government and led by the Ministry of Natural Gas Development is to attract global investment in its LNG production through a comprehensive plan to ensure that regulation, taxation, infrastructure, and logistical shipping and pipeline routes, among other factors, that are poised to attract this kind of investment. The international investors must be significant players because require a staggering amount of capital put in, which they must diversify across their entire investment portfolio. Enter: China, Korea, Japan and India — three major markets for LNG in the world.

Liquefied Natural Gas is a global collaborative project. Global players are often a combination of major markets in China and India, as well as other market players: companies, investors and producers in Canada, the United States, Australia and parts of Africa. Infrastructure development is needed in the Northeast part of B.C. to process the gas to accommodate the global marketplace and to put it into pipelines. Four of the 16 LNG project investors and companies have already selected their pipeline companies, and those pipeline companies are already working on the routes, design and consultation.

According to Mr. Coleman, they have spent approximately $300-million each on their pipeline design. Each proposed plant is a large capital investment that will require hundreds of skilled labourers. The province is working with LNG Canada and the Federal government to organize skilled and non-organized labour and devise a labour plan to meet demand in the years to come.

“It’s about building the economy and managing it as you go. And we have a really good, well-thought out, well-documented strategy that we’ve put out there, and we’re following through on,” said Mr. Coleman.

Investors and companies look at a number of factors when choosing investments in LNG projects worldwide.

“We do have competition with other areas of the world, but I think they really like our stability. They really like the fact that B.C has a Triple-A credit rating, that we balance our budget, so they know that we have financial stability. They also like the geo-political piece of Canada, because when Canadians make a deal, they live by the deal. And so they know that long-term investment—when you’re spending $25-billion dollars or more— requires making sure that your investment is not going to be jeopardized by future decisions in that jurisdiction because of instability of government and that sort of thing,” said Mr. Coleman.

In terms of the environmental sustainability of LNG, Mr. Coleman asserted that B.C. is known to have the cleanest in the world, and is setting clean emission standards for industry. A recent airshed study, an independent assessment of air quality in the region in Kitimat, commissioned by the B.C government verifies the provinces clean air standard.www.bcairquality.ca/airsheds/kitimat-airshed-assessment.html

Communities to be affected and First Nations groups have also expressed concern about environmental impact, as well as development of new infrastructure and upgrades due to the LNG proposals.

“We’ve already sat down with many of these communities and we’re working with them to look at what their strengths and weaknesses are on infrastructure,” said Mr. Coleman. “Until somebody makes a final investment decision in a particular community, only then will we know the impacts of the decision on infrastructure for sure, and then at that point we’ll know what investments we have to make in infrastructure by community.”

Moving forward toward the first final investment decision, Mr. Coleman is optimistic about the affects it will have on job creation and the GDP, both provincially and nationally, with support.

“I think it’s one of those stories in Canada that people are just starting to wake up to. This is a significant opportunity for the country. What it would do to the GDP of the country is dramatic. It would be beneficial for all Canadians, if we’re successful at it. Obviously it’s a challenge because we’re in an international market of competition,” Mr. Coleman said. “But we’re determined to be a player in this if we can be.”